PDF editing your way

Complete or edit your blank w 9 tax form 2018 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export w9 form 2018 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form w9 2018 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your current form w 9 printable by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form W-9 2018

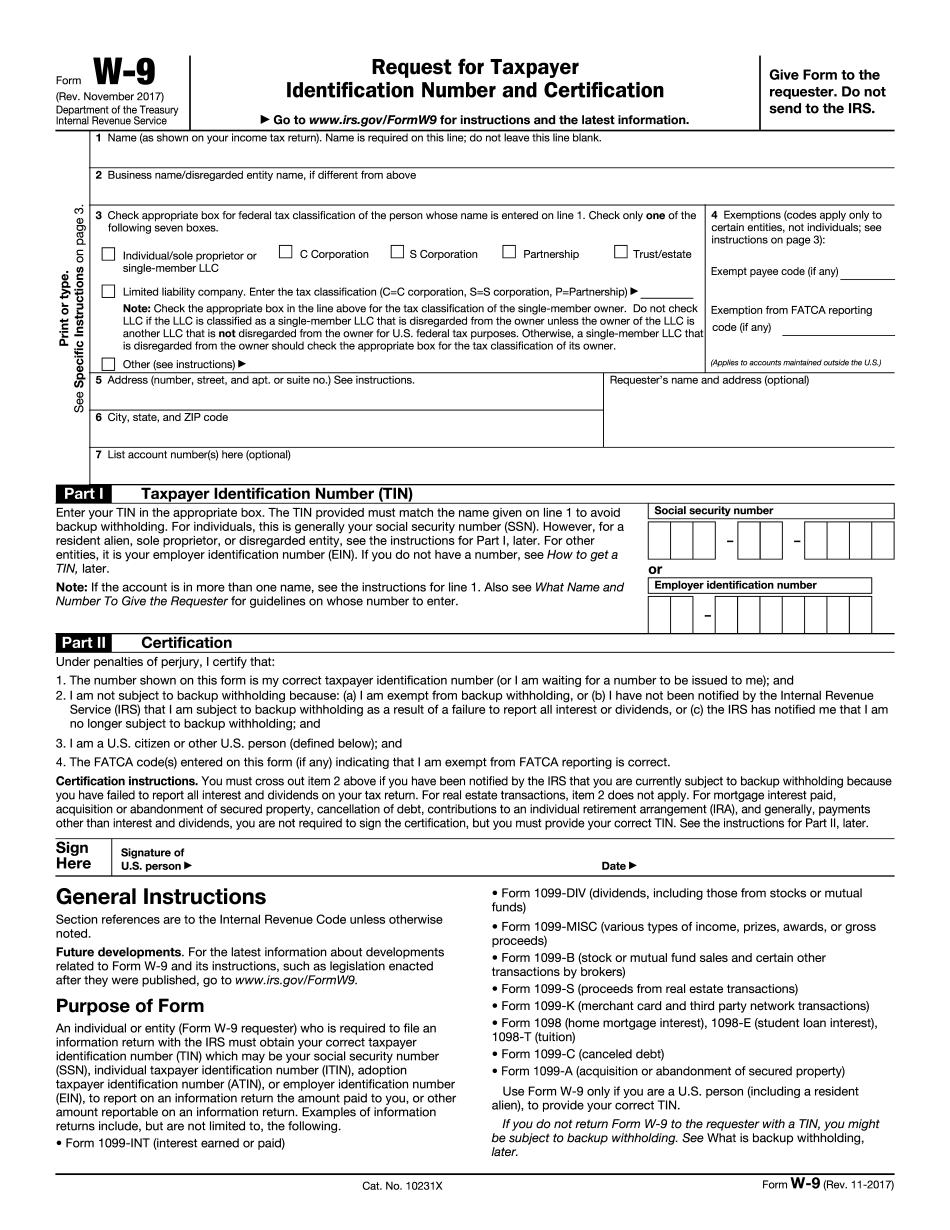

What is a W-9?

This form is usually used to pay taxes by freelancers, self-employed, or the individuals who have their own company or LLC. It is obligatory to complete a form W9 in order to avoid the payments withholding. Your income requires taxation only when you get more than six hundred dollars per year. The employer and banks may request you to prthe paper in order to make their reports about payments. Do not worry when contractor requires from you such document. The company needs it for making 1099 MICS. The taxpayer should not withhold this procedure, as he can get a penalty.

How to fill out a W-9?

The person will spend not more than ten or fifteen minutes on fillable IRS W9 Form in PDF. To complete it you may find the template on the Internet and download the printable W-9 2018 or use an online electronic version. To do it successfully follow such instructions:

- type in your full name and name of your business or organization (if any);

- define whether you are a sole proprietor, LLC owner or corporation member;

- specify the additional rules of your LLC (if needed);

- insert the exemption payee or reporting code (if necessary);

- include your contact information, date and signature.

Read all the instructions that are given in the additional part of the paper very carefully. Check all the indicated information several times (especially numbers) to avoid mistakes. Make a backup copy not to repeat the procedure one more time.

What’s the Current W-9 FormVersion?

Actually, the template remains the same. You need to submit the one if the information you provided before changed. It can be the change in your name or surname but it is not necessary to insert your new address there. One more case is when you get another type of employment or receive employer identification number instead of taxpayer identification number (TIN). Thus, the changes depend on the situation.

How to Send a W-9 2024 Online?

Once you have submitted a form, you will have to download the blank and print it, or use the function “Send via USPS”. In the first case, you can print the whole sample or the fields with information only (if you have the special blank it should be printed at). Or you can use the feature that is available when you finish the sample. Click at “Send via USPS” option. You will be redirected to the page where you will be asked to fill in the empty fields on the envelope to specify the receiver and sender of the letter. Pay attention to the fact, that the institution you have to send the form is not IRS. Address the letter with W9 blank to the institution, that required it from you.

How to Sign Form W-9 Online?

In the bottom part of the electronic document, you will see the signature field. Click on it and select one of the proposed options of identification. You may draw the signature using your mouse or touchpad, type it, or upload its image. Additionally, it can be created with the help of your smartphone. To do that, send the link to your phone using e-mail or SMS and draw it on the touchscreen of your device.

Online options assist you to prepare your doc management and strengthen the efficiency of one's workflow. Stick to the fast guideline to total Form W-9 2018, prevent mistakes and furnish it inside a well timed way:

How to complete a 2024 W 9 Form?

- On the website using the sort, simply click Start out Now and go towards editor.

- Use the clues to fill out the applicable fields.

- Include your personal info and call knowledge.

- Make sure which you enter suitable information and numbers in acceptable fields.

- Carefully test the content within the variety at the same time as grammar and spelling.

- Refer to aid part if you've got any problems or address our Support workforce.

- Put an electronic signature on your Form W-9 2024 with the help of Indicator Software.

- Once the shape is completed, press Undertaken.

- Distribute the ready kind by using e-mail or fax, print it out or preserve with your unit.

PDF editor permits you to make changes towards your Form W-9 2024 from any online world related machine, customize it according to your needs, indication it electronically and distribute in numerous approaches.