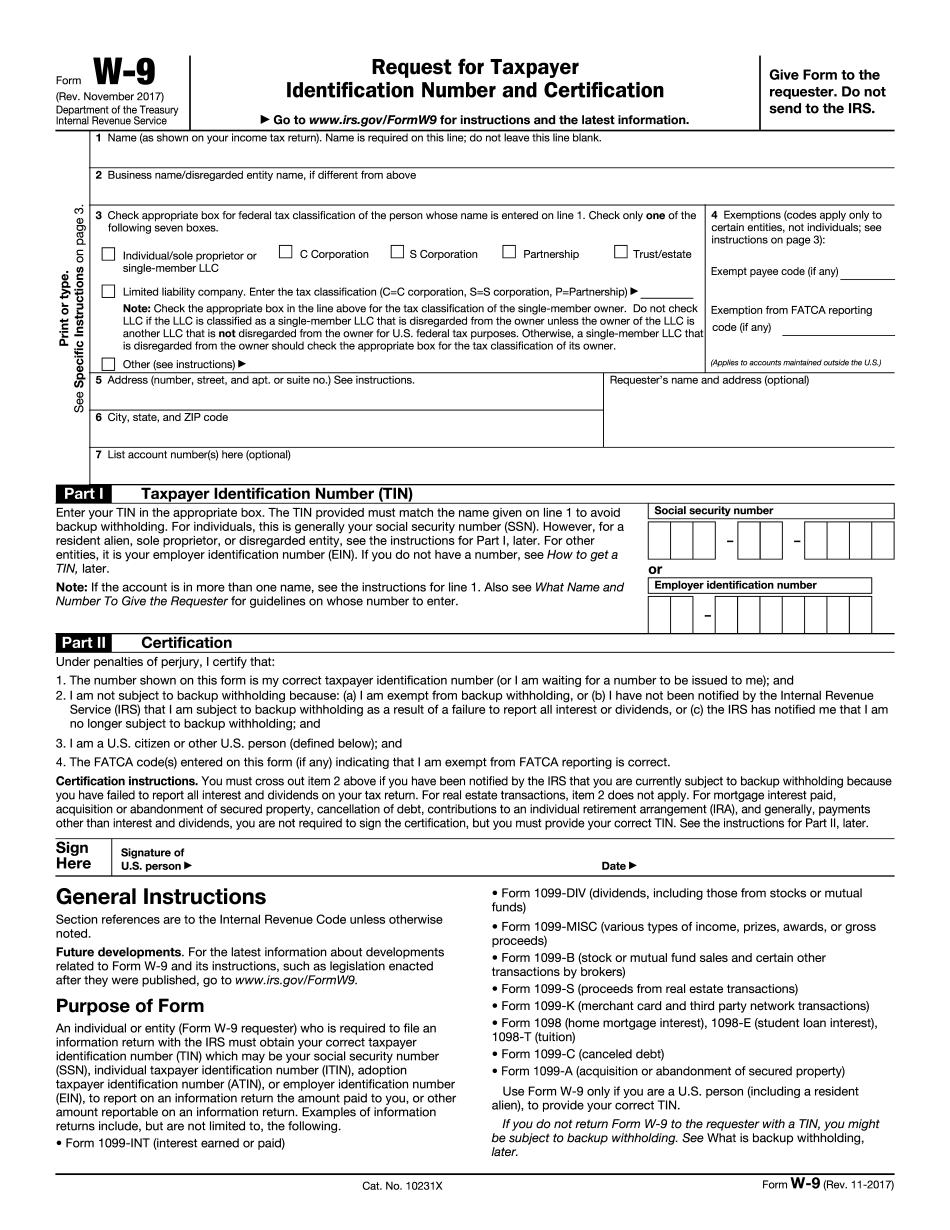

Hello guys, my name is Mohammed. Today, I'm going to explain how to fill out the W-9 form for the IRS. Let's get started. The W-9 form is used to request a taxpayer identification number and certification. It is required, for example, when opening a grocery store or convenience store and wanting to deal with wholesalers. When filling out the form, make sure to provide your name, business name, address, city, state, and taxpayer identification number (such as your Social Security Number or EIN number). Sign and date the form. It is simple and used for these specific purposes. Additionally, other entities like insurance brokers or real estate agents may ask for this form if you are dealing with them. Please note that the completed form should not be sent to the IRS. It is only for the individuals or companies requesting it. To fill out the form, enter your name (e.g. John Doe) and your business name (e.g. Corporation LLC). Then, indicate the type of entity you are (individual, corporation, partnership, etc.). The address should be your business address, not your home address. Fill in the street, city, state, and zip code. Including an account number is optional, as is providing the name and address of the entity requesting the form. Lastly, don't forget to check the appropriate exemption in number four.

Award-winning PDF software

W9 2025 Form: What You Should Know

S. Individual taxpayer identification number; and (b) If you did not file Form W-7 or Form W-9, you are not required to file an amended U.S. individual taxpayer identification number. If you are not a U.S. person, fill in the TIN box in this box, and do not include a statement as to what type of identification you are using for taxation purposes. If you have a U.S. social security number in Box 1, it is only required in this code box. If you do not have a social security number in box 1, you must use a statement (not a code) in the form. In box 28, enter the social security number of your principal reporting party if you are a U.S. person, but it is not a social security number. In box 30 you must enter your name; name of your employer; and your spouse's name, if you or your spouse filed a joint tax return and included that person's name in Box 30. In box 31, enter your date of birth; Social Security number if you are a U.S. person; and, date of birth of your dependents If you are a nonresident alien, enter your full legal name. If you did not provide required information to the tax preparer, you must complete all required fields, including, if you filed Form W-7, information under the next section. If we receive Form W-7 in the mail, we are not required to make a determination of tax filing status. See the Form W-7 instructions at Tax Laws and Regulations for Individuals. Form W-7, Request for Taxpayer Identification Number and Certification (PDF) Filing Status Code The tax return is not complete and a ruling is needed to determine your tax filing status. Nonresident Alien In Box 8, report a U.S. social security number (SSN) and the foreign tax law number (FAN) of your country of residence.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-9 2018, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-9 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-9 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-9 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W9 2025