Award-winning PDF software

Form W-9 2025 online Fort Collins Colorado: What You Should Know

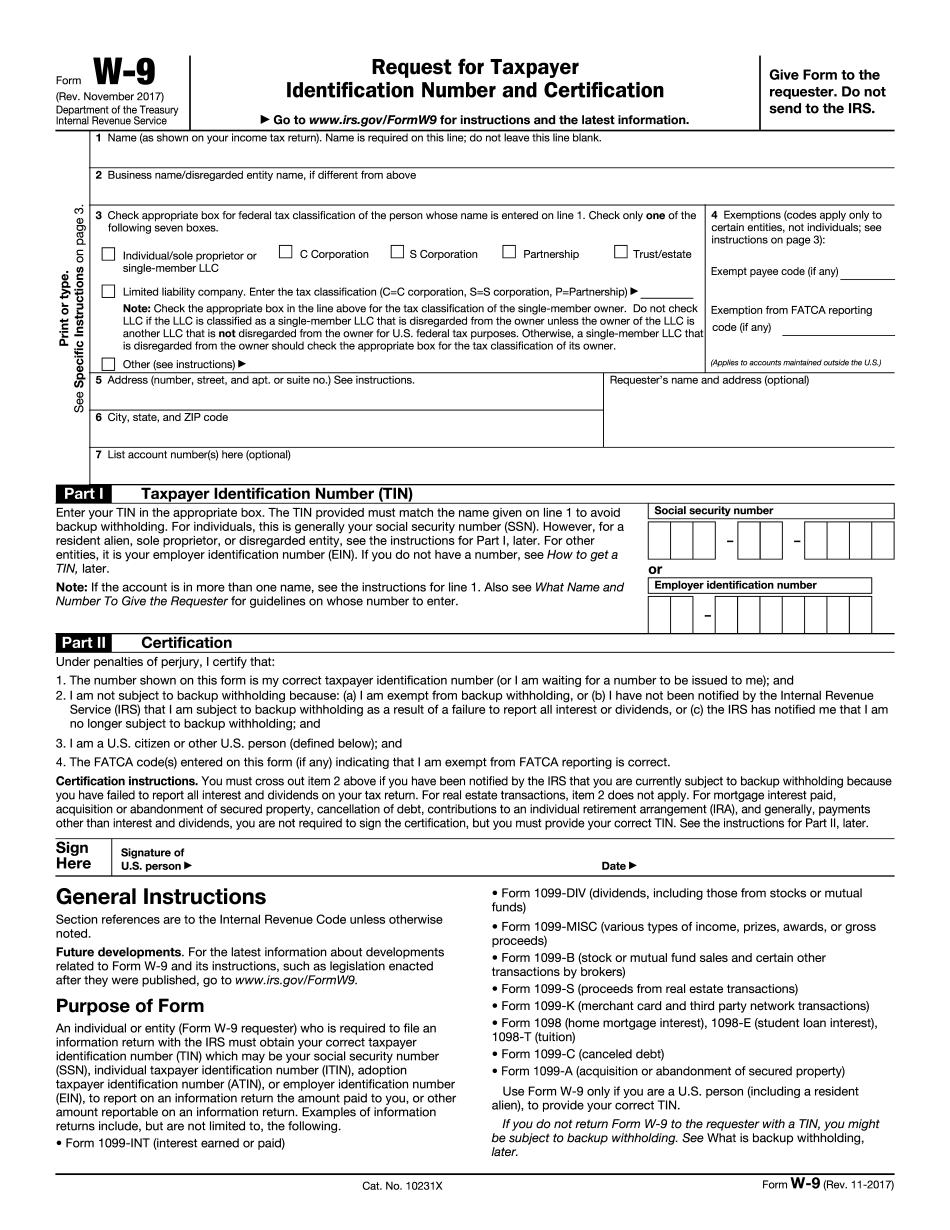

The bill is to be effective for 2025 and will also allow for the state to make a financial contribution to cover local tax increases caused by the bill's refunds. A few things to note… If you have a business in Colorado (as opposed to not operating a business) you will now be eligible for tax rebates on your business revenue up to 3,000. If you're a corporation you only need to give the corporation an amended form 1045 and send the amended form to Colorado and the corporation will receive a rebate of 5,000. Colorado will pay the IRS 1.5 million for processing refunds to businesses based in the state. The IRS will send you a Form W-9 at your home address as opposed to a Business Taxpayer Identification Number (BIN) at the address you send tax to. So if you have a business at 1130 Cherry Rd in Loveland send your W9 to the form address here, “If you have a business in Colorado you will now be eligible for tax rebates up to 750,” Colorado Attorney General Cynthia Hoffman said. “This will help Colorado businesses and families afford to move forward in a successful and sustainable way.” According to Governor Polish, if you have filed a Form 1040 or 1041, Colorado's official form for businesses, you should check with your local tax office to see whether you have received your 1040 W-9 refund. Colorado Attorney General Cynthia Hoffman said businesses can apply for their quarterly or annual W-9 or 1031. They can also apply for their Form 1065. The Colorado Department of Revenue encourages citizens to provide information about themselves and their business at so that they can receive tax credits and services that are tailored to them and their needs. You, the taxpayer, will be directed to the next screen when you enter your business identification number, your name, address, and social security number (see screenshots above) Fill out the information exactly with the appropriate spaces. If you are doing a FIFA (Federal Tax Identity Theft Analysis) check or if you are a small taxpayer seeking a reduced rate of tax paid (see screenshots below), you must fill out the box for “Yes, I am eligible for this.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form W-9 2025 online Fort Collins Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form W-9 2025 online Fort Collins Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form W-9 2025 online Fort Collins Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form W-9 2025 online Fort Collins Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.