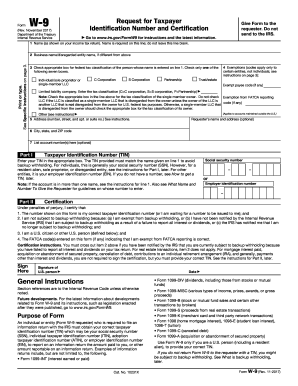

If you work as an independent contractor, freelancer or sole proprietor, you definitely have lots of benefits. You don't need to spend much time on getting to work and always can plan your day as you wish. However, you still must prepare and file tax returns regularly. In case, you are going to be paid by another sole proprietor or company, you will receive IRS form W-9 to complete.

Why to Fill out Request for Taxpayer Identification Number?

It is a widely used sample in the U.S. called Request for Taxpayer Identification Number (TIN). Further the information you specify in this paper will be required for creating some other tax forms such as 1099 and 1099-MISC. Preparing a sample you have to be very accurate. All the information must be true and sufficient. Once you finish, you must certify a file to make it legal. Your signature approves that you’ve provided valid details and confirm that a TIN specified on a blank is correct. In the other hand, it identifies whether an individual is a U.S. citizen or not.

Who Must Sign a W-9?

As we’ve mentioned above, this sample has to be signed. However, take into account that there are some limitations. According to the instructions, it has to be:

- the U.S. citizen;

- the U.S. resident alien.

Prior to starting an organization must give a consent to an individual to sign W-9 online no matter it is oral or implied. However, note that it is not obligatory for a firm to give a written authorization for filing a paper.

Who Can Submit a Template for a Corporation?

A preparer must provide the legal business name, any doing business a valid EIN. The completed W-9 must be then verified by a business owner, officer, or other person duly authorized to approve legal documents. In case your business is incorporated, the paper must be legalized by:

- one of the founders or

- someone authorized by the corporate bylaws, a resolution, or a vote recorded in the shareholder or board minutes.

Do You Need to Fill out W-9 Form as LLC or Partnership?

In some cases the blank can be prepared by the LLC that is a corporation or a partnership. The process of completing it is a little bit different from that for an individual. You have to enter the name of your enterprise as specified in tax documents. Then check the box next to “Limited Liability Company.” Be sure to indicate a “C” for corporation or “P” for partnership on the classification line. Don`t forget about the business address, city, state and zip code and the LLC’s employer ID. Note that you don't have to provide your SSN as the number should belong only to the name on the first line. A final version must be also dated and then sent to a requester.

Can the Attorney Complete The Form?

If you cannot fill your request personally for some reasons, you can delegate the right of certification to the authorized representative. In case, you are acting on behalf of an entity, be sure you are authorized to do so. The final version can only be confirmed under a Power of Attorney if it specifically states that the agent is eligible on tax matters.

Who Can Help a Minor with The Blank?

The under-age individuals are not eligible to certify a file personally. In order to authorize it, a minor's parent or legal guardian must complete a document.

Refuse to Submit W-9

The first thing you have to know is that unsigned request isn`t considered to be legally binding and it won't be accepted. The signature is required to confirm that all the information provided on a document is true and correct. Otherwise, it will be invalid.

How to Digitally Fill and Sign The W-9 Form?

As technologies are constantly improving, today it is possible to certify your forms electronically just in seconds. You need to accomplish a few simple steps:

- open a fillable template in PDF;

- type all required details into empty fields;

- choose the way to add your mark, i.e. by typing, drawing, uploading or capturing it with a webcam;

- drop it on the appropriate line;

- then click the “Done” button to save the changes.

Signature Requirements

The first thing you should be aware of is that you have to use only certified and reliable services for signing your papers. Note that a completed blank must be certified by the person identified on W-9 or his/her authorized agent.

When to Prepare W-9?

The filled template must be fully completed prior to filing. There is actually no specified date as it is usually certified by a preparer when all the requested details are furnished.